Biodiversity loss is a bigger risk to businesses than carbon emissions

Memory chipmaker Micron is pausing construction on a manufacturing facility in northern New York state by at least six months because the wetlands it plans to destroy on the site are home to two species of endangered bats.

Micron was aware of the bat risk when it started environmental reviews for the factory, funded with a $6.1 billion grant under the federal CHIPS and Science Act, and it is waiting until the colonies migrate for the winter. But the snag underscores the danger of overlooking nature in corporate decision-making.

More than half of the world’s gross domestic product, about $44 trillion, is highly or moderately dependent on nature, according to the World Economic Forum (WEF). The impact extends beyond food and agriculture to pharmaceuticals, manufacturing, real estate, financial services, mining and other extractive industries.

“I think the saying is, we use nature because it’s free, but we lose it because it’s got no value to us on a balance sheet, like other parts of our decision-making in the corporate world,” said Rayne van den Berg, former CFO of Australian logging company Forico and global lead for GIST Impact, a service provider gathering analytics and data about nature risk.

“We’re going to have to find ways to talk the same language and be able to present information and find common dialogue around what value really means beyond just financial,” van den Berg said at GreenFin 24. The conference, in mid-June, was hosted by the publisher of this website.

The math on nature risks

Five of the top 10 risks anticipated by business leaders in 2033-2034 are linked to climate change or nature, including biodiversity loss, ecosystem collapse and natural resource shortages, according to C-suite executives surveyed by WEF.

An April analysis of nature degradation related to the U.K. economy predicts up to 12 percent of the country’s GDP is at risk by 2030. The U.K. is already one of the most nature-depleted countries in the world, and at least 50 percent of the risks it faces originate overseas, according to the analysis.

“Risks from environmental degradation and biodiversity loss are at least as severe and urgent, and indeed if not addressed, will double climate change losses,” said lead author Nicola Range, an expert on finance and biodiversity affiliated with the University of Oxford. Those risks include soil quality, invasive species, diseases, water contamination and availability, microbial health and supply chain disruptions.

More than 80 percent of companies have a strategy for emission reductions, but just 5 percent have goals for biodiversity loss, according to Raviv Turner, managing partner of consulting firm NatureX Studio, at GreenFin. “Carbon is not our biggest risk [nor] the most immediate one,” he said. “It’s biosphere integrity, it’s biogeochemical” concerns that impact every living organism.

Nature risks take three primary forms, Turner said.

Big pharma and the plight of the horseshoe crab

A stark illustration of nature-business dependency comes from the pharmaceutical industry, which relies on endotoxins in the blood of horseshoe crabs to test vaccines. The crabs are bled and returned to the wild in a weakened state, which compromises their ability to reproduce. Populations have declined by two-thirds in the Delaware Bay over the past three decades.

Eli Lilly developed a synthetic alternative that has failed to earn widespread adoption among U.S. pharmaceutical companies because of corporate politics, said Margaret O’Gorman, president and CEO of the Wildlife Habitat Council. “This is an industry that has a risk and a dependency that it’s causing,””she said. “They refuse to actually see that the solution is there and adopt the solution.”

Transform environmental metrics into balance sheet data

Many companies already collect data about emissions, waste management and water consumption. But they often don’t use them as metrics for expressing financial risks tied to nature, said Terryn Lawrence, chief sustainability officer at Rabobank North America, an investment bank focused on food and agriculture, metals and commodities.

“Land. Water. Soil. These are all things that are incredibly important assets … that haven’t historically been on balance sheets,” she said.

Sustainability professionals can help corporate finance teams consider what losing access to these resources could mean for the business, Lawrence said. For example, as private equity firms buy up land across the United States, how might that affect farmers if water rights are altered? Companies are looking at their supply chains more closely since the Ukraine war, Lawrence said. They’re asking questions such as: “What if our input costs skyrocket? What if this commodity isn’t available? What if this no longer grows here?”

Forico and BHP show the way with ‘natural capital accounting’

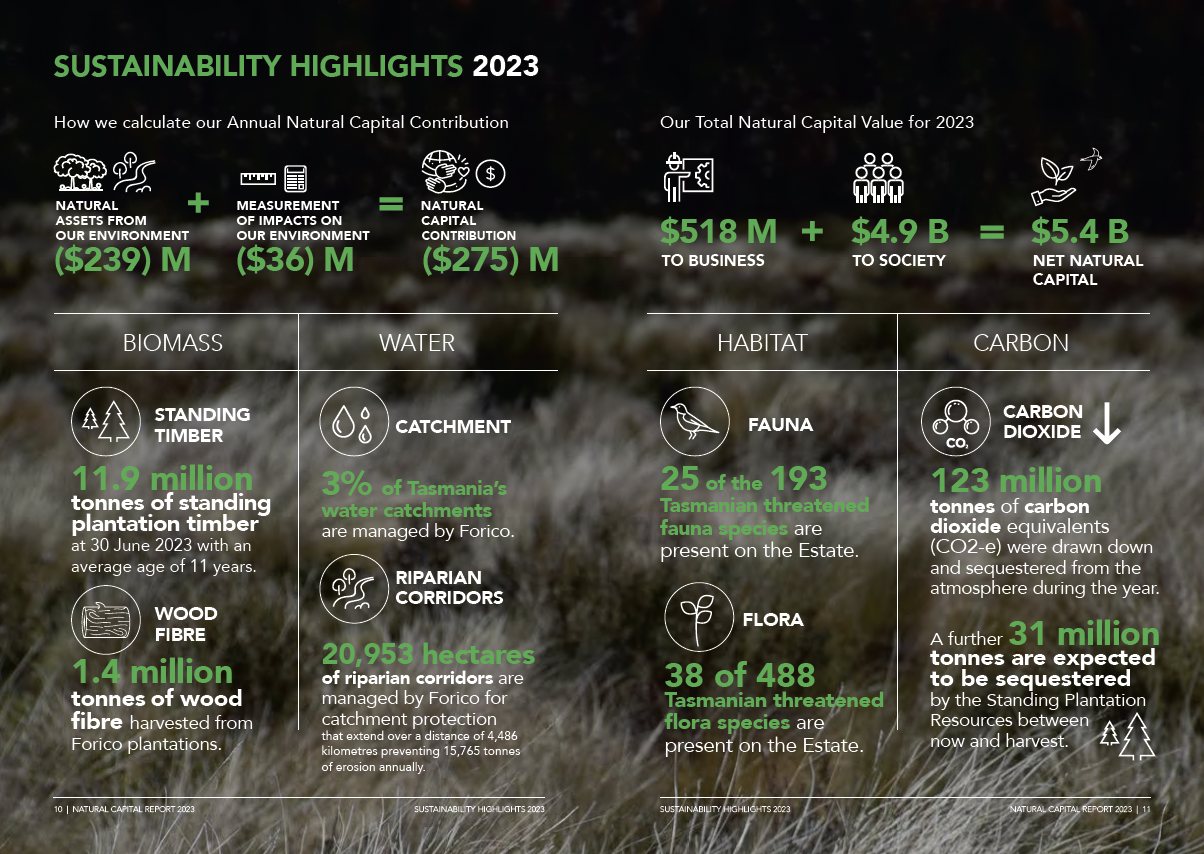

Forest company Forico began publishing its “natural capital” information in 2020. (The latest edition can be found here.) That meant thinking beyond the financial value of the wood chips the company ships to China and examining how Forico’s land makes a difference in habitat, carbon sequestration, water quality and other areas, said van den Berg.

“Our ecologist had been doing amazing work, and our foresters and other people across the organization had been gathering lots of metrics … We took these notional values and created a balance sheet,” she said. “What we found is, conservatively, when it comes to nature, our contribution to society was five times more than our traditional balance sheet. That got people’s attention really, really quickly around the boardroom table.” Those “contributions” include the carbon-sequestering value of timber on Forico’s lands (along with future potential), the water managed in catchments there, and restoration of riparian corridors important for endangered species.

An example of Forico’s natural balance sheet is below:

Mining company BHP is piloting a similar “natural capital accounting” process at the Beenup mineral sands site in western Australia. There, it’s studying the impact of restoration and conservation projects, including habitat for four threatened plant species. Among the metrics BHP is measuring:

- Net gains in habitat and geomorphic diversity

- Restoration of ecological “connectivity” across habitats

- Increase in per-hectare land values

- Gains in carbon sequestration and storage potential

- Improvements to water quality and flows

- New revenue opportunities, such as wildflower harvesting or beekeeping

Innovation inspired by nature

Biodiversity impact assessments are increasingly crucial for corporate research and development, said O’Gorman, pointing to an unnamed European petrochemical company evaluating biological alternatives for producing vanillin, an anti-inflammatory and flavoring ingredient. Close to 95 percent of vanillin produced today is linked to petrochemicals.

On the surface level, substituting those chemicals with lignin, a plant fiber produced from biochar, makes sense for reducing emissions. But the company’s CSO, who was included in the discussion, challenged the engineering team to probe more deeply into the sources it was considering: lignin from Brazilian steel production or lignin from Indigenous communities.

O’Gorman declined to disclose which source was chosen, citing non-disclosure agreements, but suggested this sort of conversation points to the future of corporate innovation. “This was a discussion literally driven by the CSO into product development, but centered on biodiversity, not climate,” she said.

The post "Biodiversity loss is a bigger risk to businesses than carbon emissions" appeared first on Trellis