Office Conversions Set To Outpace New Construction In 2025

More office space will be removed from the U.S. market this year than added to it for the first time since at least 2018 and likely longer, providing another indicator of the market’s stabilization and nascent recovery, according to a new report from CBRE.

By the end of this year, 23.3 million square feet of space is slated for demolition or conversion to other uses, according to Conversions & Demolitions Reducing U.S. Office Supply, CBRE’s analysis of office-market activity across the largest 58 U.S. markets. In comparison, developers are projected to complete construction of 12.7 million square feet of office space in those markets in 2025.

Construction completions have steadily declined from 51.2 million square feet in 2018 to 25 million last year and the anticipated 12.7 million this year. Meanwhile, conversions alone – factoring out demolition – have increased from 5.5 million square feet in 2018 to an anticipated 12.8 million square feet this year.

CBRE has tracked office conversions and demolitions since 2018. Construction completions have exceeded conversions and demolitions in each year until 2025. Completions likely exceeded conversions and demolitions prior to 2018, given that office construction was robust and conversion activity minimal in past decades.

Various other indicators depict a U.S. office market that’s slowly turning the corner. Net absorption – the amount of space newly occupied in a quarter versus the amount newly vacated – has been positive for the past four quarters after six straight quarters of negative absorption. Office-leasing activity increased 18% in the first quarter from a year prior. Still, the national vacancy rate continues to hover around its all-time high of 19%.

Developers currently have another 81 million square feet of office space in the pipeline for conversion to other uses in the coming years.

“This net reduction – albeit slight – of office space across major markets likely will contribute to lowering the vacancy rate in the quarters ahead, which would benefit building owners,” said Mike Watts, CBRE Americas President of Investor Leasing. “However, the conversion trend faces a few headwinds. The pool of ideal buildings for conversion will dwindle over time. And costs for construction labor, materials and financing remain high.”

Tariffs are yet another factor in that they have increased the cost of many construction materials and contributed to economic uncertainty that makes financing large projects challenging.

Market-By-Market View

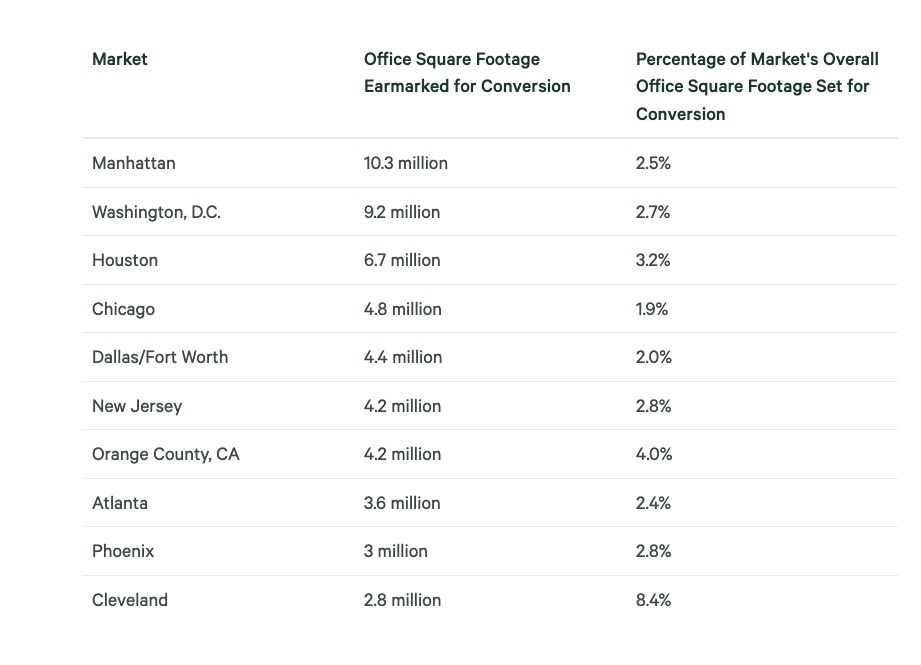

Conversion activity varies widely by market. Manhattan; Washington, DC; and Houston have the most office square footage planned or under construction for conversion. Meanwhile, Cleveland (8.4%) and Cincinnati (6.6%) have the largest percentage of their overall office square footage under conversion.

As of last month, 76% of these active conversion projects are planned to become multifamily complexes. The next most popular option, hotels, account for only 8% of the conversion pipeline. Life sciences labs, previously among the top options, have fallen to 3% of the pipeline, behind “other” uses (10%) and Industrial & Logistics uses (4%).

Learn more about building design and construction on Facility Executive.