4Q Cost Report: Construction Execs Report Increased Optimism for 2026

ENR’s Construction Industry Confidence Index rose four points between Q3 and Q4, to a slightly optimistic 52 rating. The economic index also rose four points, to a 48 rating.

The confidence index measures executive sentiment about where the current market will be in the next three to six months and over a 12- to 18-month period, on a 0-100 scale. A rating above 50 shows a growing market. The measure is based on responses by U.S. executives of leading general contractors, subcontractors and design firms on ENR’s top lists to surveys sent between Oct. 27 and Dec. 8.

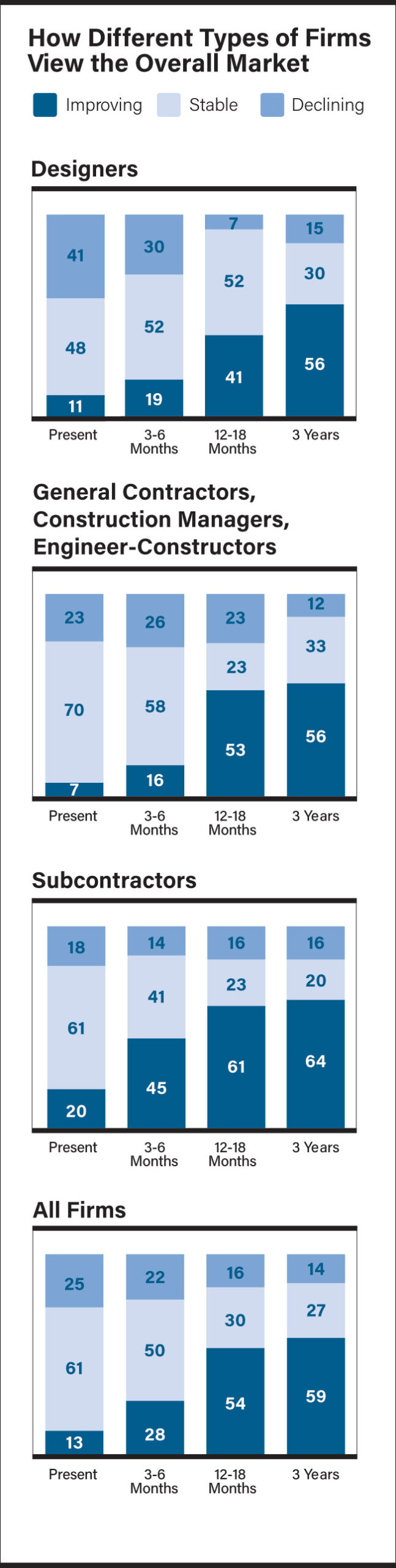

Construction executives report much more optimism about where the market will be 3-6 months from now than they did last quarter. In Q3, 30.2% of respondents foresaw a declining market in 3-6 months with 21.7% seeing an improving market. In Q4, those numbers have virtually inverted. Now, 28.1% see an improving market in 3-6 months with 21.9% seeing a decline.

Subcontractors report significantly higher confidence than either design firms or GC/CMs. Taken separately, their confidence rating rose 12 points from Q3 to a 59 rating. GC/CMs confidence fell five points to a 47 rating, with design firms up three points to a 44 rating. When considering the market 3-6 months from now, the difference is even starker. Subcontractor confidence comes in at 66 for that time frame, with both GC/CMs and design firms at 45.

The results of the Confindex survey from Princeton, N.J.-based Construction Financial Management Association (CFMA) also saw a slight positive upturn in Q4.

Each quarter, CFMA polls CFOs from general and civil contractors and subcontractors on markets and business conditions. The resulting Confindex is based on four separate financial and market components, each rated on a scale of 1 to 200. A rating of 100 indicates a stable market; higher ratings indicate market growth.

Source: ENR/BNP Media

Source: ENR/BNP Media

Source: ENR/BNP Media

The overall Confindex is up two points to a 106 rating this quarter. Financial conditions rose 2.9% to a 109 rating in Q4, with the year-ahead outlook index up 4.4% to a 118 rating. Both the business conditions and current confidence indices stayed the same, with 105 and 97 ratings, respectively. The current Confindex has remained under the benchmark 100 rating since Q2. With one exception, it had been above 100 since Q2 2021. The 21-point difference between that index and year ahead outlook indices is the largest gap between them since Q4 2020.

“I’m a bit surprised by some of this optimism because of the trajectory of construction spending,” says Anirban Basu, CEO of Sage Policy Group and a CFMA advisor. He also points to AIA’s Architectural Billings Index, which remains below the benchmark reading of 50, suggesting that design work is contracting.

Basu sees expected lower project financing costs driven by falling interest rates as a prime mover of the relative optimism among construction execs. The Federal Reserve voted to cut interest rates by a quarter point on Dec. 10.

He thinks firms who are hoping for more rate cuts next year may be disappointed. “Inflation is stubbornly above the Federal Reserve’s 2% target, and recent readings have suggested that inflation might be re-accelerating,” he explains. Just over 18% of ENR survey respondents reported their clients’ access to financing has been somewhat or much easier than six months ago, up from 4.6% in Q3.

Also feeding optimism for 2026 is the sense that tariffs have not been as impactful as economists predicted, says the Sage CEO. “We’re talking about 50% tariffs on steel, aluminum and copper. That’s not insignificant, but the global market for some of these commodities is so weak, in part because the Chinese economy is growing just around 4% now, that these tariffs have acted more like a floor than actually pushing prices much higher.”

Basu continues to see data centers and power as the only two markets with real momentum going into 2026. Confidence in the power market came in at a 93 rating this quarter on ENR’s survey, the highest ever rating for a market.

“Am I concerned about an AI bubble? Yes I am. But am I concerned about it bursting in 2026? Not so much from the perspective of construction,” he says. He points out that Meta, AWS, Alphabet and Microsoft have all committed to major data center programs in 2026. “The spending is so substantial that Amazon has had to go into the debt market to finance some of this investment,” he adds.

The Sage economist thinks home building may pick up in 2026. “A lot of home builders think that if we get below 6% on a 30-year fixed mortgage rate, things will really start to take off. And we’re almost there.” Demolition is another segment that looks to do well in the coming years. “[We have] so many abandoned shopping malls, so many derelict Class B and Class C office buildings right now.”

One segment where Basu sees the impact of tariffs is in manufacturing-related construction. “50% of what we import are intermediate goods, and so for manufacturers, costs have gone up and margins have shrunken.” He cites the Institute for Supply Management’s Manufacturing Purchase Managers Index, which has been below the threshold rating of 50 for nine consecutive months.

The post "4Q Cost Report: Construction Execs Report Increased Optimism for 2026" appeared first on Consulting-Specifying Engineer