Inside Patagonia’s comprehensive plan to counter rising emissions

Patagonia needs to cut greenhouse gas emissions by an average of 10 percent each year to reach its commitment to be net zero by 2040.

Like most other apparel makers, it’s struggling to deliver on that promise in a global economy complicated by trade wars and shifting ESG regulations.

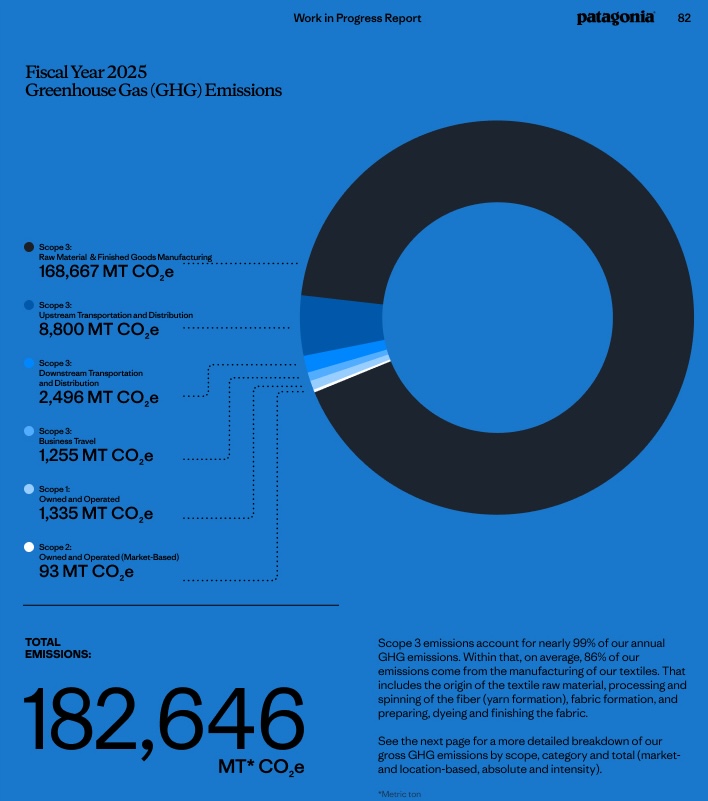

For its 2025 fiscal year ended April 30, the 52-year-old, storied outdoor gear and apparel maker’s footprint rose 1 percent to 182,159 metric tons of carbon dioxide equivalent.

The big reason for the year-over-year rise: “more carbon-intensive” materials in new duffels and packs, which were a larger part of its product assortment, the company said in its first comprehensive environmental and social progress report published Nov. 12.

Raw materials and finished goods manufacturing accounted for 92 percent of Patagonia’s footprint in fiscal year 2025, according to the 130-page narrative, which pulls together disclosures that the Ventura, California, company makes on its website, through certification audits and to nonprofits.

Patagonia, which had revenue of $1.5 billion in FY2025, compiled the information so employees, customers and suppliers could learn more about the evolving best practices that it uses to reduce emissions. Since its 2017 baseline year, Patagonia’s emissions are up about 19 percent.

Unique perspective

As a private company, Patagonia isn’t required to report its climate progress, but the company’s leadership felt it important to counter the rise of greenhushing and to demonstrate that companies should still talk about their work. It hasn’t committed to a publishing cadence.

“Patagonia is not perfect by any means,” Founder and ex-CEO Yvon Chouinard, now 87, said in a note leading the “Work in Progress” report. “We do not have all the answers, but the fear of getting things wrong in the process cannot stop us from trying to get things right in the end.”

The company’s near-term targets include reducing emissions from its direct operations and purchased electricity by 80 percent by 2030, compared with 2017. Patagonia has pledged to cut absolute emissions from its supply chain by 55 percent in that same timeframe.

Chouinard, along with current CEO Ryan Gellert, oversees Patagonia’s climate strategy and approves long-term, multimillion-dollar decarbonization investments. Patagonia is organized under a unique ownership structure: the Patagonia Purpose Trust owns the voting stock (2 percent) with the rest held by Holdfast Collective, an environmental nonprofit that has received $180 million in dividends since it was created in 2022.

Progress: It’s complicated

Patagonia gives itself passing grades on two of four 2025 environmental goals in the report: eliminating “forever” chemicals from its fabrics and buying 100 percent of materials from “preferred” sources certified as having reduced climate impacts.

It reached 84.4 percent overall for the latter goal, but made particular progress on using recycled polyester (93 percent) and nylon (89 percent), which significantly reduced the company’s dependence on products made from fossil fuels.

Patagonia measures every product using its proprietary Ironclad Quality Index, which evaluates design metrics such as how materials can reduce environmental impact; manufacturing indicators, in an effort to minimize defects that cause returns; and use factors such as durability.

“Responsibly made high-quality products that are multifunctional, durable and repairable can be used for years and years,” the company said in the report. “As a result, they reduce waste and take full advantage of valuable resources already extracted. Quality, for us, is an environmental attribute.”

For example, Patagonia’s Black Hole Duffel has a score of 9.3 (out of 10), compared with a score of 7.2 in 2016. One reason was a decision to replace a thermoplastic polyurethane made from virgin petroleum with a recycled material that had the same qualities but had a matte finish instead of a shiny one. The potential risk to sales was worth it, the company said.

Supply chain: the path forward

The report also outlines several new initiatives intended to encourage more direct action on decarbonization in Patagonia’s supply chain — which contributed 95 percent of its emissions in FY2025. They include:

- A pilot of a new carbon accounting approach that would allow Patagonia to get credit for investments it funds for suppliers, such as electrification, that reduce emissions.

- The use of an internal fee — called the Verified Carbon Intervention Unit — that calculates the price of emissions reduction measures and factors this into contracts with Patagonia’s 10 biggest partners. This represented a $37.3 million operational expense in FY2025.

- A policy that requires suppliers to write a coal-phaseout plan and share the timeline.

- A “no carbon offset” mandate that applies both to employees and partners.

- An environmental impact manual that lays out compliance requirements for its supply chain; new suppliers must pass a related screening process during their onboarding.

Untapped potential: Product recycling and reuse

The analysis is rife with contradictions, including high hopes for plans to recirculate and reuse materials even though there is no clear recycling pathway for at least 85 percent of its products.

For example, a typical rain jacket could include at least three different fabrics bonded together with adhesive.

Just 1 percent of the products Patagonia has ever made have been returned for recycling. Just 20 percent of those can be processed; the rest are being stored “indefinitely” until Patagonia can figure out what to do with the items. This requires an industry-level response, the company said.

The post "Inside Patagonia’s comprehensive plan to counter rising emissions" appeared first on Trellis