Rising global temperatures have been affecting climate patterns for decades. The frequency and severity of acute events, such as wildfires on the western coast of the U.S. or 1-in-1,000-year rainfall events in Dallas show that the impacts of these small but accumulative changes in climatic conditions are picking up pace. It’s not only the acute events that we are witnessing. Chronic physical risks, such as sea level rise, glacial melts and resultant flooding, are causing havoc in low-income countries.

BSR’s three climate scenario narratives explore the worsening physical impacts of climate change. These impacts are nearly identical over the next decade. However, climate modeling data suggests the possibility of a radically better pathway if we raise our current climate policy ambitions.

Even in the most ambitious policy scenario, “Net Zero 2050,” the world suffers from the “locked-in” physical impacts resulting from emissions that have already been released into the atmosphere. It is only by the mid-2030s that physical impacts start to diverge because of increased ambition. While business will have to prepare for physical impacts over the next decade, they must take bold action now to prevent irreversible and potentially catastrophic consequences in the long-term.

Financial impacts on business

The financial impact on business is yet to be fully considered. Natural disasters, disruptions to supply chains, a need for increased cooling, water scarcity and increased environmental costs are all examples of climate-related costs driving down national GDPs. Scenario analysis points to these costs increasing in emerging and advanced economies alike. Eventually, these costs will trickle down to the bottom line of businesses globally.

For example, data suggest that in the absence of business investment, there is likely to be a decrease in labor productivity and economic activity. The “Current Policies” scenario , which assumes a continuation of 2020 climate policies, sees a significant loss of labor productivity due to heat stress, with as much as a 12 percent global decline by the end of the century. By contrast, in the Net Zero 2050 scenario, impacts on labor productivity would stabilize from 2035 onward.

Business can assess physical risks beyond asset exposures and begin thinking of investments toward systemic change that safeguard against severe long-term physical impacts.

How transition risks will materialize

Carbon regulation, whether through direct taxes, trading schemes or other various pricing instruments, now cover more than 30 percent of emissions globally, extending across regional, national and sub-national jurisdictions.

The global average price of carbon, however, continues to fall short of levels sufficient to account for the increased marginal damage of an additional metric ton of CO2 emitted into the atmosphere.

Keeping within the remaining carbon budget, however, necessitates much higher prices over the coming decade. In the case of a coordinated net-zero transition, companies can expect a predictable and steady upwards exposure to transition costs.

In contrast, with an uncoordinated and hasty global response, as is the case in the “Delayed Transition” scenarios, the private sector may be forced to comply with disparate policy regimes and exposed to volatile carbon prices. Such an unpredictable transition policy shock will leave business exposed to unmitigable risk across their value chains. When this shock happens, the urgency of the situation will dictate higher transition costs over a longer period, far beyond 2050. Pricing in emissions now, however, ensures that business plans for such uncertainty well in advance and can pivot and capitalize on opportunities as governments pull available levers to promote drastic decarbonization.

Evolving needs for investment

If we are to collectively reach net-zero emissions, the energy system will need to forerun the global economy and decarbonize much sooner than 2050. Climate models suggest these investments will need to substantially increase over the next 10 years.

Businesses are not directly addressing their own energy consumption. While mechanisms such as renewable energy credits or virtual power purchase agreements have gained popularity in high income countries, national grids in emerging economies remain fossil fuel-heavy. Companies can take direct action to curb emissions from fossil fuels, especially in emerging markets. Practically, this means increased corporate investment in on-site renewables in countries where global corporates have a presence, participating in policy engagement platforms at the national and sub-national level, and actively engaging suppliers to reduce emissions. This ensures that businesses setting net-zero commitments take substantive action and can credibly demonstrate tangible decarbonization.

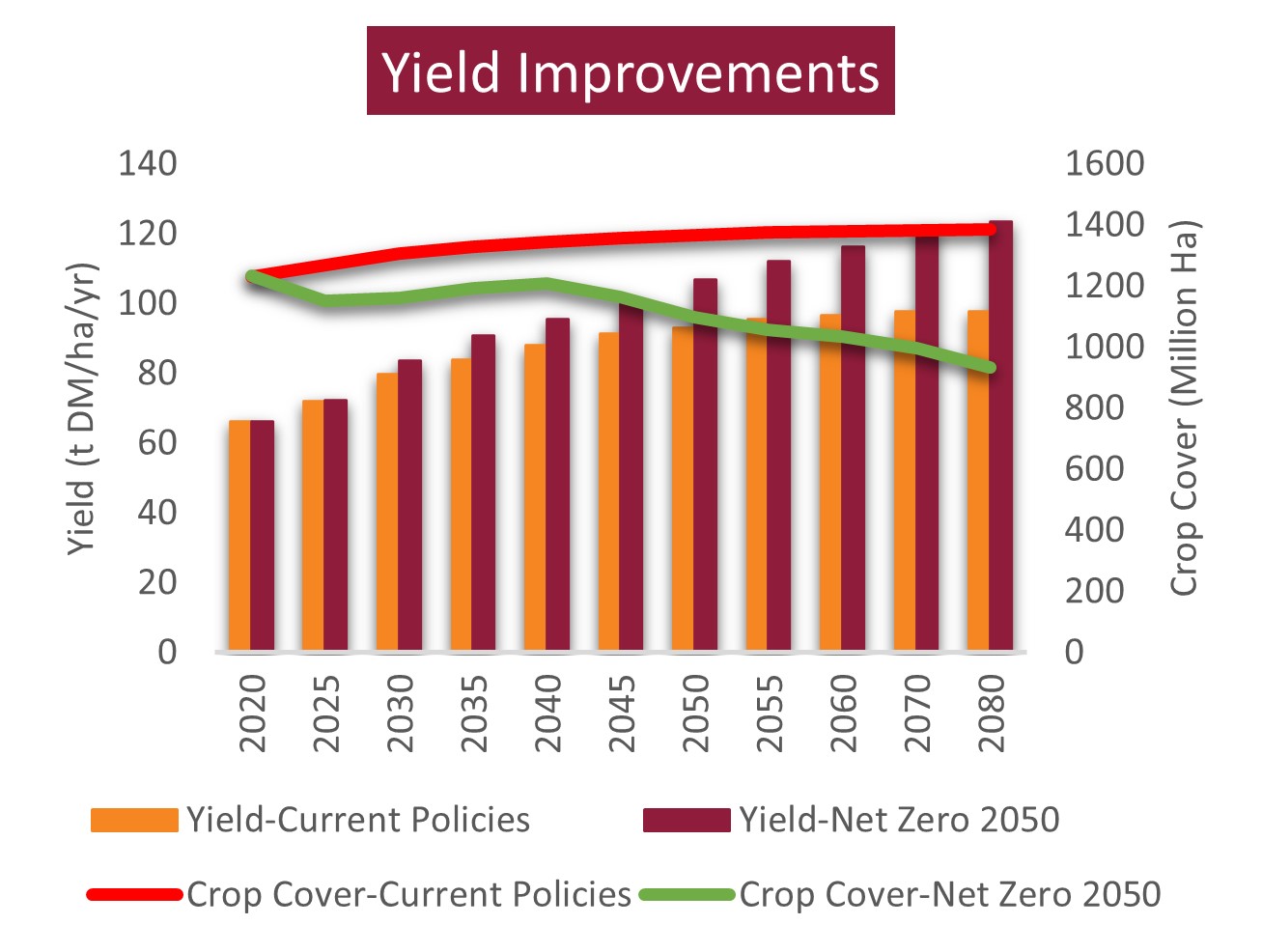

The challenge to deploy capital to existing climate mitigation solutions is well understood. It is equally important to invest in research and development (R&D). In the specific case of agriculture, our use of land resources requires transformational shifts. Competing priorities, such as protecting and restoring forests and meeting the demand for bioenergy and food crops, will mean that agricultural systems will have to produce more with less to keep up with rising demand. Sustained investment in internal R&D programs, adoption of sourcing practices that support regenerative and sustainable production, and backing disruptive startups are just some examples available to food, beverage and agriculture companies to enable the transition to a net-zero state.

Business can accept business disruption, and in some cases, permanent changes to operating environments caused by climate physical impacts — this is the new normal. Additionally, transition risks such as carbon pricing and changing market conditions present transition risks that, if left unaddressed, leave business exposed to shocks. By committing to R&D in climate solutions and making tangible and real investments, business stand to improve their resilience to climate change risks.

The post "3 big implications of climate risk to business" appeared first on Green Biz

0 Comments