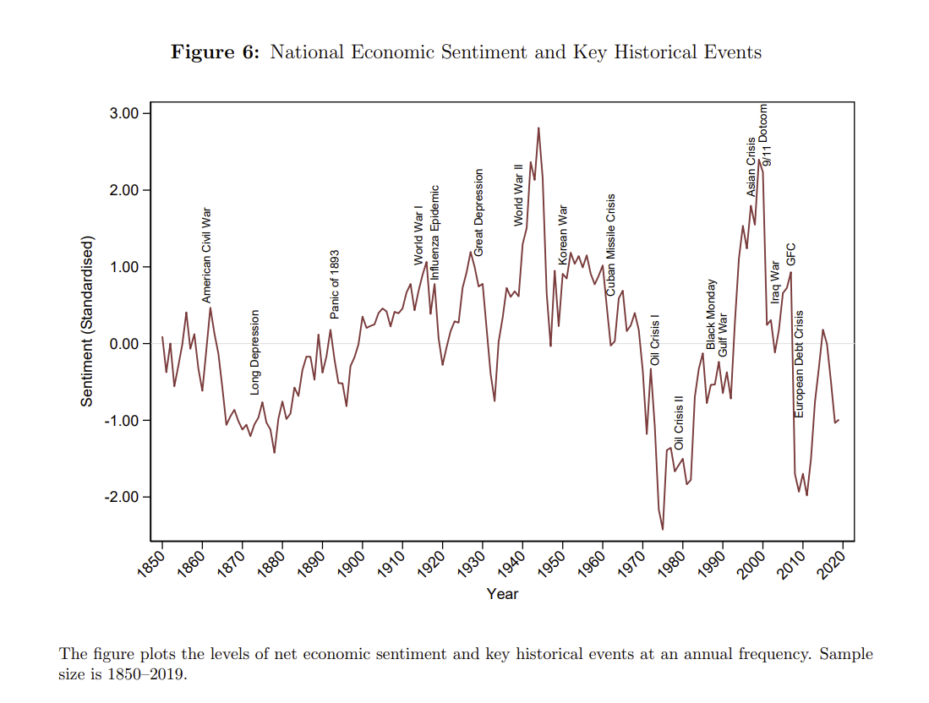

A study by experts at Wharton and elsewhere captures changing economic sentiment over 170 years to predict fundamentals such as GDP growth, employment, and monetary policy decisions. The study leads conventional forecasting models on several counts: in time series by more than a century; in capturing important information existing models fail to capture; in granularity that tracks nationwide and state-level variations; and in cross-sectional variations.

The study’s findings are published in a paper titled “(Almost) 200 Years of News-Based Economic Sentiment,” authored by Wharton finance professor Jules H. van Binsbergen, London Business School finance professor Svetlana Bryzgalova, London Business School doctoral student Mayukh Mukhopadhyay, and Nanyang Business School finance professor Varun Sharma.

The study customized a machine learning technique to create an algorithm that analyzed more than a billion articles across 200 million pages of 13,000 U.S. local newspapers from 1850 to 2017; the authors claimed that dataset is 95 times larger than the total amount of all of the English-language Wikipedia entries combined. The inclusion of local newspapers enabled them to measure sentiment on a granular basis at the city, county, and state levels.

“If you want to better understand the role that sentiment has on economic activity, GDP growth, labor market decisions, and other fundamentals, it’s always better to have more granular and longer time series data,” Binsbergen said. “We show this sentiment has predictive power for economic activity over and above the standard predictors such as the so-called yield spread, or the difference between long-term and short-term interest rates as well as lagged GDP data (or economic growth after it occurred).”

Leading Conventional Forecasts

Significantly, the study’s model leads the Philadelphia Fed’s Survey of Professional Forecasters in predicting the next quarter’s consensus value of macroeconomic fundamentals, and it betters the Michigan Survey of Consumer Sentiment in the length of time (the Michigan Survey is available from 1966) and in providing state-level variations; the common component of national news and local news is only 35%, and the remainder is made of local news.

The paper explained how its algorithm does a better job than standard forecasting models in predicting future GDP per capita growth. A one standard deviation increase in sentiment corresponded to 2% additional GDP growth over the next year in the sample period from 1850 to 2017, it stated. Furthermore, for the period from 1947 to 2019, for which it has yield curve data (a common recession indicator), it showed that a one standard deviation increase in sentiment led to 0.29% of additional GDP growth one quarter ahead, which corresponds to 1.1% annualized growth. “Overall, our results indicate the importance of sentiment in understanding the business cycle,” the paper noted.

The study’s measure operates mainly through the labor channel rather than the capital channel, as it predicts employment, consumption, and services but neither investment nor industrial production. Similarly, it showed that economic sentiment operates through the real economy and does not predict inflation.

Degrees of Predictive Power

“Our measure seems to have mainly predictive power – not on the investment side, or what machines and other capital goods companies invest in – but rather on the labor market side,” Binsbergen said. “It seems to have predictive power for hiring decisions [at companies]. Higher sentiment implies more hiring and lower sentiment predicts lower hiring.”

“If you want to better understand the role that sentiment has on economic activity, GDP growth, labor market decisions and other fundamentals, it’s always better to have more granular and longer time series data.”— Jules H. van Binsbergen

The study also found that sentiment has a large influence on the key policy rate, particularly during recessions: a one-standard-deviation decrease in sentiment over the past two quarters leads to a 25-basis-point decrease in the policy rate. “Driving these effects to influence interest-rate decisions are two factors, the paper explained: One is economic sentiment and its ability to predict GDP growth and employment; and the other is how sentiment could induce the Federal Reserve to deviate from the so-called Taylor Rule, which links interest rate decisions to changes in inflation and economic growth.

Economic sentiment, however, does not seem to have predictive power over stock market returns, but Binsbergen explained how that might play out. “One way to interpret our findings is that the stock market seems to understand what the influence of sentiment will be on economic activity, and has already priced it in. Since it is already captured in the price today, it doesn’t predict price movements in the future.”

The economic sentiment tracked by the study coincided with many prominent economic crises such as the Great Depression, the Great Recession, and the recession of 1973–1975, the paper noted.

Tracking Words, and Their Context and Intensity

The algorithm in the study worked by looking at the context in which a word/phrase is used, not the physical distance between words in a given sentence. It selected one billion words at random for each five-year period in the sample from 1850 to 2020 “to ensure that the corpus is balanced across history and that each of the time periods has consistent representation.”

The algorithm was trained to respond to a dictionary of words and phrases related to the economy. The word “economy” was most closely associated with words and phrases such as economic growth, inflation, recession, and economic recovery. Similarly, it relied on “seed words” that reflect positive sentiment such as expansion, boom, growth, and prosperity, while those for negative sentiment were words such as recession, bankrupt, shrinking, and unemployment. The paper captured the top 1,000 words and phrases in a word cloud:

Tracking the “Secular Stagnation Period”

Significantly, the sentiment tracked a downward trend that began in the 1970s, or what is known in macroeconomic literature as a “secular stagnation period,” the paper noted. “We show that this trend is not driven by the coverage of economic news but rather relates to the overall mood,” it added. It pointed out that after the U.S. elections of 1992, many studies have focused on “the apparent negativity bias in media” and that “the media disproportionately focuses on negative economic news.”

The paper attempted to explain that dominance of negative news. “Because the public needs to be made aware of important risks in society, a certain level of general negative bias in the news coverage is expected, particularly if one adheres to the view that traditional media fulfills a watchdog/surveillance function,” it stated. But it found that to be an inadequate explanation, and added, “The world of news, especially that of printed newspapers, has become increasingly competitive over the years. It is natural, therefore, to expect that in order to attract a larger audience, many outlets have been increasingly focusing on negative news.”

Hurdles in Identifying Information Sources

Is there a way to use the algorithm in the study to capture sentiment in the future, too? “In principle, there is nothing against keeping on updating our database and using the same algorithm,” Binsbergen said. But the problem is in determining what represents an authoritative source of information when it comes to news reporting, he noted. “If I just gave you the local newspapers, I think you would object. I think you would say, ‘Is that enough? Is that everything?’” At the same time, including other sources of information, such as on social media, is also fraught with hurdles such as negativity and fake news, he added. Determining the right mix of information sources remains a challenge, he indicated.

In any event, Binsbergen is happy that their study has advanced forecasting techniques. “There are people that forecast GDP for a living, and they include professional forecasters at banks and asset managers and other places,” he said. “It seems that our sentiment measure leads their forecasts, meaning that it seems to run more information than what professional forecasters seem to be using in their forecasts.”

That said, it is not possible to predict economic fundamentals with absolute precision. “Our measure does have decent predictability, but within plausible ranges,” said Binsbergen, who will be discussing the study further in a webinar hosted by the Jacobs Levy Equity Management Center for Quantitative Financial Research. “If we could perfectly predict the next crash, then the crash would happen today.”

0 Comments